- The agriculture ministry is developing Krishi-DSS, a decision support system, on the lines of Gati Shakti, using RISAT-1A and VEDAS of Department of Space

NEW DELHI : The Department of Agriculture and Farmers Welfare and Department of Space signed a Memorandum of Understanding (MoU) to develop the Krishi-Decision Support System (Krishi-DSS) using geospatial technologies and related databases for enhancing evidence-based decision making capability of all the stakeholders in the agriculture sector.

The Ministry of Agriculture and Farmers Welfare is developing Krishi-DSS, a decision support system, on the lines of Gati Shakti, using RISAT-1A and VEDAS of Department of Space. This will enhance the evidence-based decision-making capability of all the stakeholders in the agriculture sector by way of integration with MOSDAC and BHUVAN (Geo-platform) of ISRO and systems of ICAR.

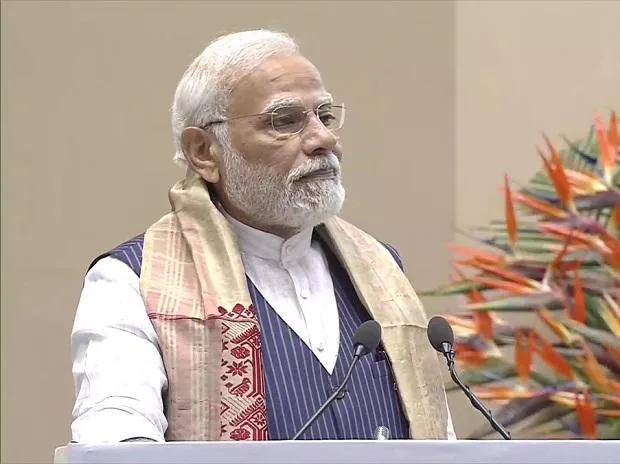

Addressing the occasion, Union Minister Narendra Singh Tomar said that a new dimension is being added in the field of agriculture. “Revolution is being initiated in the agriculture sector through space science. The agreement between the Department of Agriculture and the Department of Space will further enhance the strength of the agriculture sector. If this knowledge reaches the farmers, their production and productivity will increase. The quality of production will increase and export opportunities will also increase.”

Tomar added that the agriculture sector is very important in our country and in the whole world. “Along with livelihood, this sector is working to speed up the country’s economy and provide employment to a large population.”

He said that earlier the sector had suffered due to lack of knowledge and private investment. “The amount of change, knowledge and investment needed in this area has not happened. This is the reason why the agriculture sector has not progressed as much as it should.”

The minister added that in the year 2014, when the Prime Minister took over the work, he had a desire to take the country forward. “Work was done to connect it with new dimensions. Because of this, all the departments including the Department of Space changed their working methods, fixed targets and planned effective targets. Its effect is visible in the country today. Agriculture Department is also working on AgriStack. Work is being done to increase the income of the farmer and to save him from losses by forecasting.”

Tomar said that crop estimation, allotment to states, survey to declare an area dry, disaster assessment, – all these tasks will become easy after adopting technology. “This technology is very beneficial for the agriculture sector as well as the country. After the completion of AgriStack, there will be a revolutionary change in the field of agriculture. “

A technical workshop was also organized by ISRO as part of the event, wherein case studies and potential applications were demonstrated using RISAT-1A data for the benefit of the user community. RISAT-1A data is received, processed and disseminated by the National Remote Sensing Centre (NRSC), Hyderabad, through its Bhoonidhi Geoportal.

Earlier in the day, Tomar and Union Minister Jitendra Singh released the data products and services of RISAT-1A satellite for the user community.

Read more at-https://bit.ly/3VZbrJ9